Bitcoin is the Trojan Horse to Crypto Civilization

Why is the world destabilizing, and what comes next?

Long-form podcasts are great, but have two problems:

high information density and

trapped value in 3 hour discussions.

My proof of work is mining hidden CryptoGems💎, and unleashing them onto the world. If you’d like to tap into the smartest minds in web3, subscribe here:

This week on CryptoGems💎:

The Reputational Civil War.

Inflation and Potential for Bitcoin Seizure.

Future Scenarios of the US and China.

Bitcoin and Energy.

India’s Rise in Crypto.

① Mining Source ⛏

② CryptoGems💎

The Reputational Civil War, Future Scenarios of the US and China, Inflation and Potential for Bitcoin Seizure

#01💎 If China’s got a state-controlled press, America’s a press-controlled state. So the org chart is the other way, who can get who fired, who’s superior?

#02💎 Journalists holding politicians accountable means that the US is a press-controlled state. It also means by the way, how’s that accountability doing? If journalists are holding politicians accountable and over the last 30 years, the US government has done very poorly, who’s holding accountable the people who are holding the government accountable?

#03💎 We are in the midst of the beginning of a reputational civil war, where the weapons are provided by companies that produce tools for social media. It is like neighbor against neighbor. And I find that absolutely terrifying. – Tim Ferris

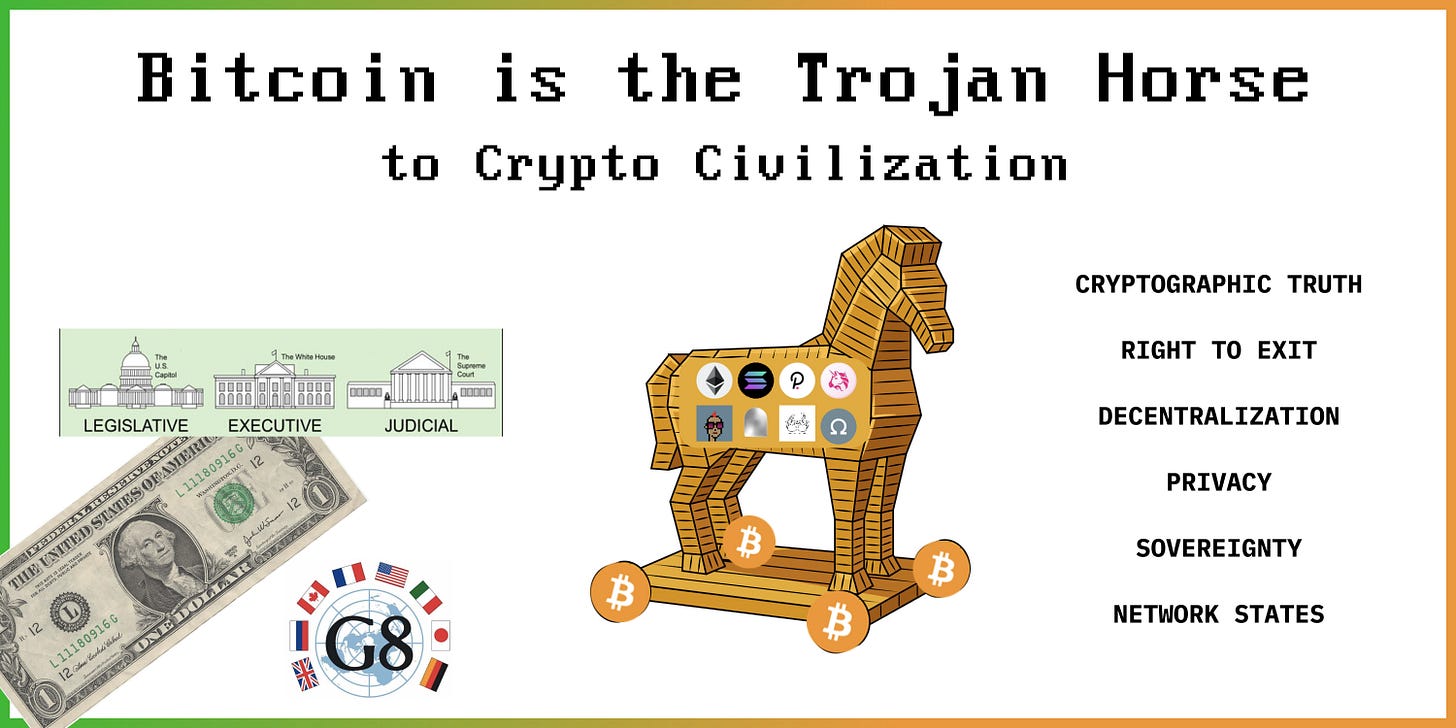

#04💎 Right now we’re seeing insane levels of money printing. And it is certainly possible that at some point in the future, they try something like an Executive Order 6102.

#05💎 If you’re trying to seize BTC in a time of rampant inflation, that is no longer something that can be portrayed as being for the good of the population because inflation touches everybody. It touches White people, Black people, Latina people, Asian people. It is economics. It really is the state versus the people.

#06💎 If inflation is rampant, any attempt to seize BTC, could be the match for the next wave of conflict.

#07💎 Coins on exchanges are easier to seize than coins off exchanges.

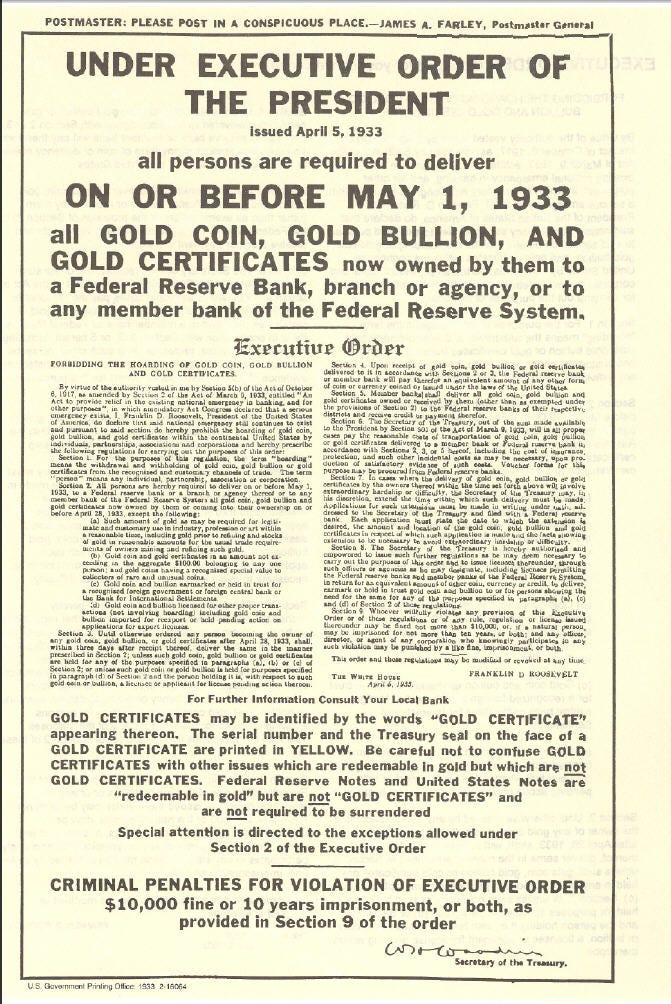

#08💎 Cryptocurrency, because it solves the principal-agent problem and replaces it with your ability to debug.

#09💎 With cryptocurrency, a program can now trade on your behalf. You can, rather than hiring a banker to go and trade for you, write a program that will trade for you while you sleep on decentralized exchanges worldwide.

#10💎 You go from a human bank account to a cryptocurrency address and you remove the human association. Now a program can hold money, make money, lose money fully autonomously. And so now rather than hiring the banker you write the program.

#11💎 As trust in society decreases, it is harder and harder to maintain a scaled organization of human beings, because there’s more and more divergence.

#12💎 The answer is going to be robotics cryptocurrency. How do those things relate? Well, when you give a robot instructions to go and unpack a box, it just does it. There is no divergence between the capitalist and the worker. The capitalist is the worker, because management becomes automation.

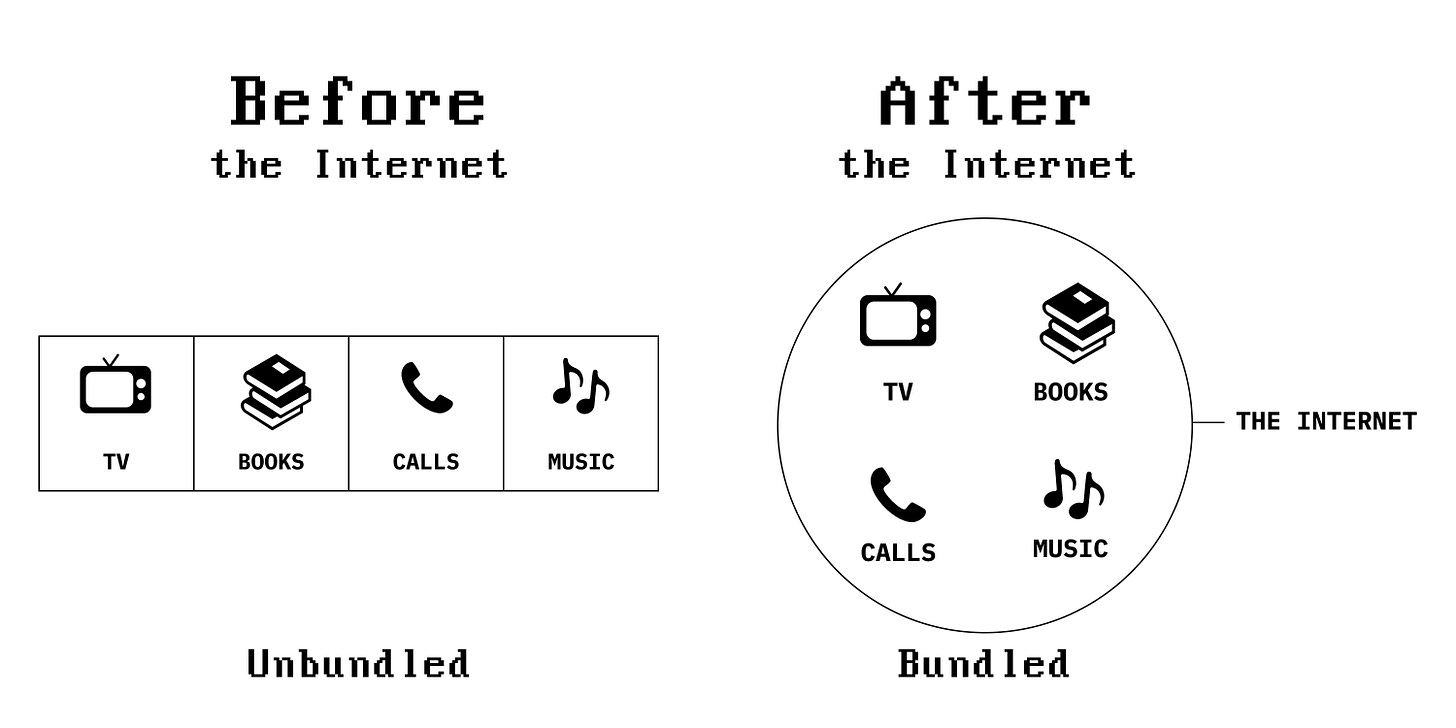

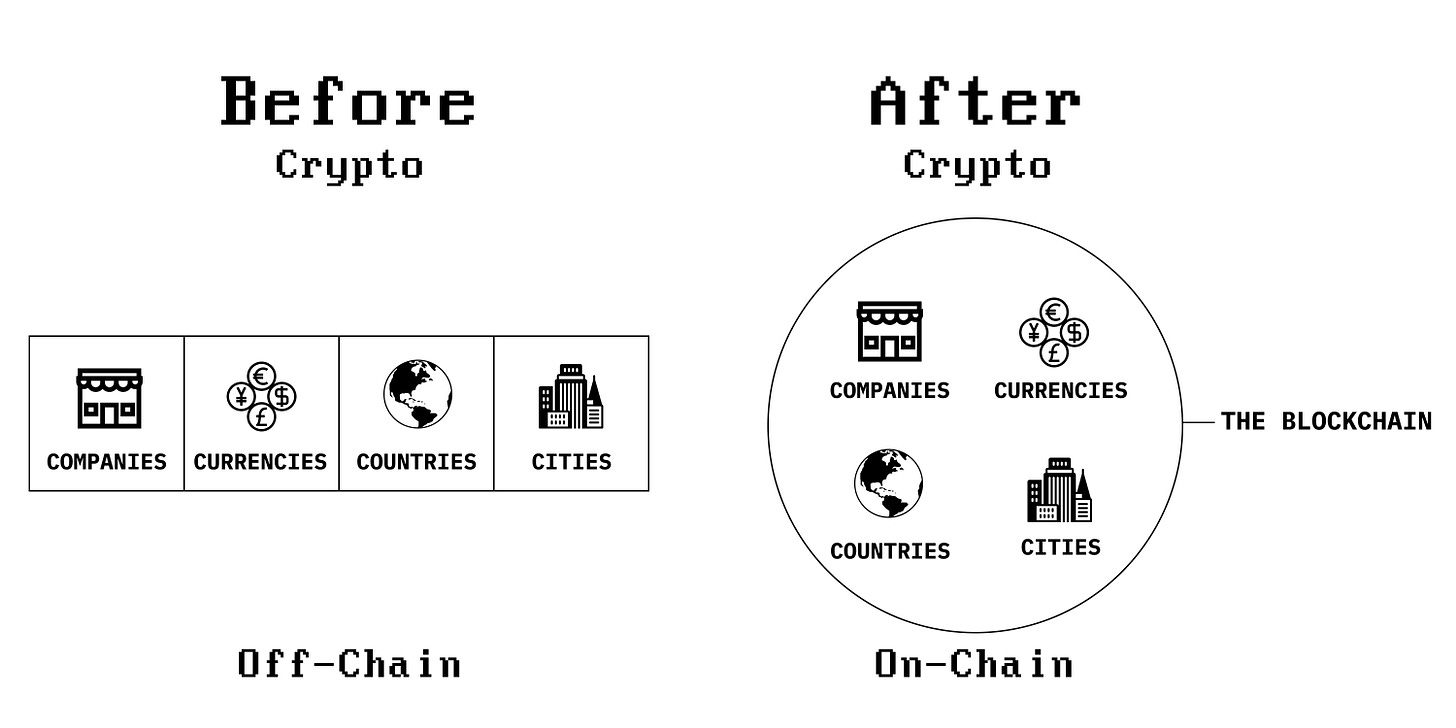

#13💎 People have sort of forgotten how bad war is in some ways, so they’re kind of LARPing it.

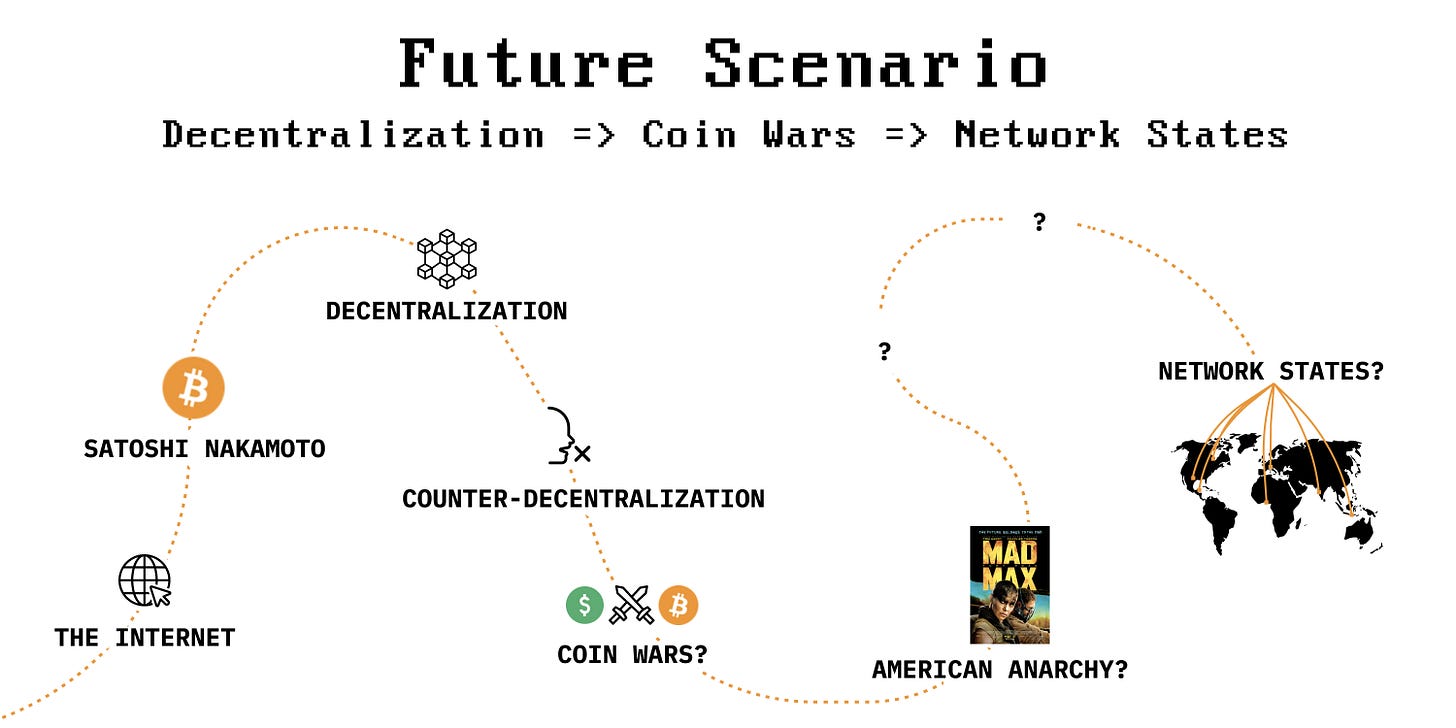

#14💎 You can think of the era we’re in as the decentralization and now the counter-decentralization.

#15💎 So just like the printing press and Martin Luther kicked off the Reformation, the internet and cryptocurrency have kicked off the decentralization.

#16💎 What does a counter-decentralization look like? It looks like deplatforming from social media platforms, unbanking, the Chinese surveillance state, it looks like basically exercising root control.

#17💎 And the counter-decentralization, I believe, is going to succeed in China and fail in the US.

#18💎 I think China is going to win the counter-decentralization. People thought that their bans and controls on the internet wouldn’t work, but they kind of did.

#19💎 The US establishment is not selected for folks who look ahead, it’s selected for actors and propagandists. It’s not selected for capital allocators.

#20💎 The US establishment that’s always behind the eight ball. Lehman is a surprise. Bear is a surprise. COVID is a surprise. Trump is a surprise. Afghanistan’s a surprise. Everything is a surprise. And then they react in this very reactive way.

#21💎 The US government is losing control over both domestic and international affairs and so states and cities within the US will take positions at variants with the Feds because cryptocurrencies are becoming so valuable to them that they’ll have the equivalent of sanctuary states and sanctuary cities for crypto.

#22💎 Crypto entrepreneurs will write model legislation that will be adopted by places like Texas and Wyoming and Colorado and Florida and other kinds of things that, for example, prevent Bitcoin seizures in law before the thing happens.

#23💎 Domestically, basically the feds would step in and force states to do something. But over the last few decades, what we’ve seen are sanctuary cities for immigration, we’ve seen states have different gun laws, we’ve seen states have different marijuana laws.

#24💎 States are becoming genuinely differentiated from each other and from the federal government.

#25💎 Tim Ferriss: If you had to live in the United States, where would you live and why? Balaji: Texas or Florida. Probably Florida. Why? Because those are becoming freedom states. I think Wyoming’s also good. I think Colorado under Jared Polis is really good.

#26💎 The Center and South of the country are going to diverge from the West coast and the Northeast, I think, roughly speaking, but that’s not straight Democrat, Republican. That is more decentralization versus centralization.

#27💎 Companies, currency, cities, countries, communities, all settle around chains. That is like the software stack for running a community. an analogy to this is before the internet, books and movies and music and songs, television, telephone calls, those are all different. And then after the internet, they go turn into packets and all kind of mixed together.

#28💎 Right now we sort of think of companies, currencies, cities, countries, communities as being different things, but they’re all going to become the same thing.

#29💎 The great resignation, the great migration, remote work, lockdowns, all this stuff has made people both more aware of how important the policy is of the state that they’re in and were able to move.

#30💎 The future business model of governments, is A, subscription and B, inflation.

#31💎 Bitcoin is necessary as a corrective to 20th century fiat.

#32💎 Bitcoin is short-term volatile but shows immense long-term appreciation. The US dollar is actually the opposite. It is short-term, relatively stable. But over the long term, you can see it has had a huge drop in purchasing power.

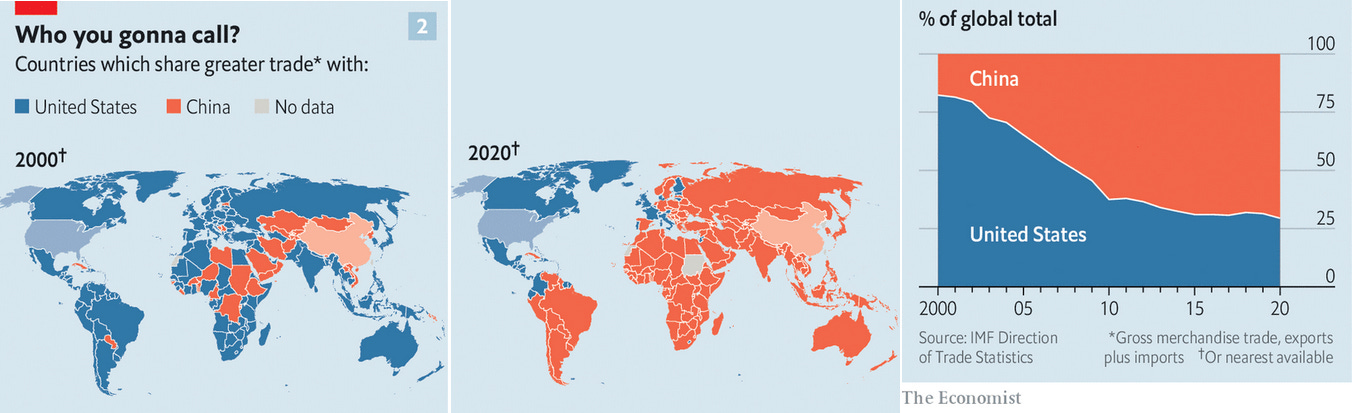

#33💎 Order book mean price discovery. Supply and demand are now computable, visible, tangible. As we cryptify the whole world, it’s not just BTC, USD, that has an order book, it’s every asset versus every asset.

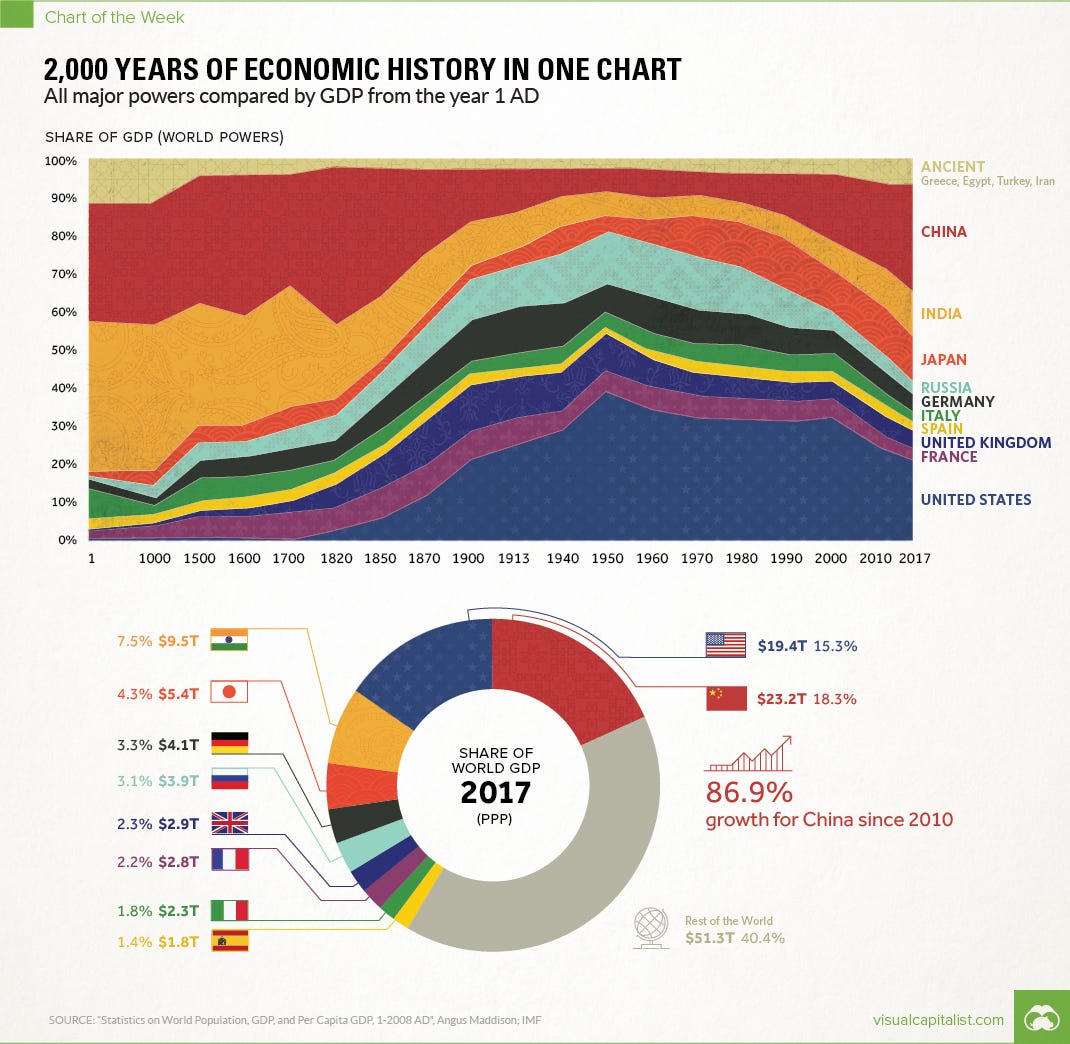

#34💎 Digital wallet mean you can hold every asset on your computer. Not just Bitcoin, not just Ethereum, but fiat currencies like CBDCs when central bank digital currencies come out, every stock, every bond, every NFT, every video game potion, you have a billion items in your digital wallet, those billion items, you don’t just hold them, you trade them against the billion items.

#35💎 The DeFi matrix means everything is just getting re-priced all the time. Every asset competes against every other asset. People don’t understand how big a deal this is.

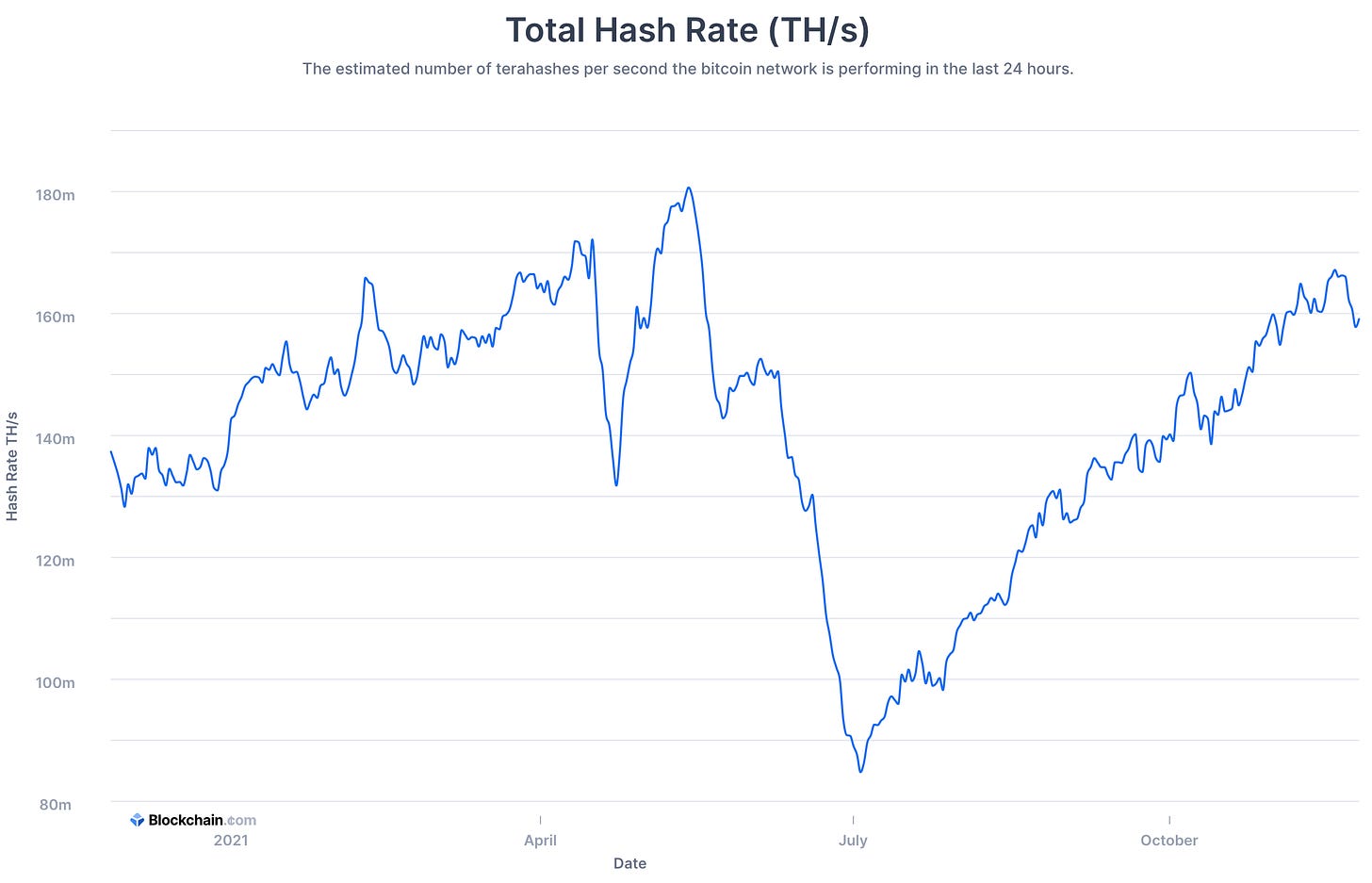

#36💎 When every asset is competing against every other asset is extreme capitalism. There’s no geographical advantage anymore.

#37💎 The DeFi matrix will be to this decade what the social graph was the previous one.

#38💎 We're moving from the tiered two-party system to the wired and city system.

#39💎 It’s actually more and more common now for crypto projects to ban Americans from buying into them. The US throwing its weight around with sanctions and threats, is suddenly starting to realize that, it’s backlashing on them.

#40💎 Both China and the US are driving away their best — actually, all three corners of that triangle: NYT, CCP, and BTC, their fundamental weaknesses are they’re driving away some of the best.

#41💎 The coming conflict is going to be centralization versus decentralization, where it’s going to be fiat versus Bitcoin.

#42💎 I think that the tyranny doesn’t have enough state capacity to sustain for long.

#43💎 In a time of tyranny, what’s scarce is freedom; in a time of anarchy, what’s scarce is leadership.

#44💎 If China has centralized censorship by the state, in the US, because the First Amendment prevents that, you have decentralized censorship by corporations. It’s technically compatible with the First Amendment, but it’s spiritually not compatible.

Geopolitics, China's Rise, China banning Bitcoin Mining

#45💎 In many ways in 1991, the US was the hyper power, after the collapse of the Soviet Union. Over the last 30-ish years it has blown maybe the biggest lead in human history.

#46💎 Now rather than winning everywhere without fighting, the US fights everywhere without winning.

#47💎 Tech and Asia are up and to the right on many different kinds of graphs. Whether it’s global trade or it’s number of smartphones or it is the number of people using cryptocurrencies.

#48💎 The West is declining a percentage of GDP, in terms of its relative military strength, in terms of its internal cohesion, and in terms of just raw percentage of the world. Yet all of these institutions that were set up years ago kind of assume Western predominance.

#49💎 China is the exception to the sovereign individual thesis where they want root over everything.

#50💎 So even the Chinese government going after Bitcoin mining, it slowed down transactions a little bit for a few weeks, but not really all of it.

#51💎 The US made a startup investment in China (when Nixon went there), because the USSR was the number one rival at that time. They executed phenomenally well over the last 35 to 40 years. And now they have the internal market size, to be the number one movie market in the world.

#52💎 There are three eras of China, the Mao era was revolutionary communism, then Deng, Jiang, and Hu was internationalist capitalism. And now I think it’s fair to say under Xi Jinping, it’s now pretty clear that it’s sort of a nationalist socialism, militarism, and economics is no longer first.

#53💎 China has changed. It is now a different thing than what you and I grew up with, which was the internationalist capitalism of the Deng, Jiang, and Hu era.

#54💎 There’s a huge difference, by the way, between China and Japan, which is that Japan is literally occupied by the US military.

#55💎 The US basically wrote Japan’s operating system and constitution after World War II. And they have literally a military base there. And I think in a real sense, they are an independently operated US subsidiary.

#56💎 The purpose of NATO was to keep the Americans in, the Germans down, and the Russians out.

#57💎 Because China wants to maintain root, I think they’re going to have significant short and perhaps even medium-term advantages. But in the very long run like 20, 30, 40 years, I think the century lines up as centralized China versus a decentralized world.

#58💎 The future of hard power is CCP. And the future of hard money is BTC.

#59💎 Communist capital says, you must submit. Woke capital says you must sympathize. Crypto capital is saying you must be sovereign.

#60💎 I think what we want to do is carve out a decentralized center that has a healthy optimum between these with the recognition that different people will trace out different optima.

#61💎 A corporation is not a democracy, but it is responsive to its customers in a certain way and the Chinese government was always kind of conscious of losing the mandate of heaven and having too much dissatisfaction.

Bitcoin and Energy

#62💎 Bitcoin mining is now like a money battery. Rather than trying to store that energy in a battery, you store it as money by mining Bitcoin. And depending on the economics, it may be better to do that.

#63💎 Renewable energy source are volatile, like solar power or wind. Even if there isn’t demand on the grid (for example the sun is shining, but nobody’s turning on their appliances or the wind is blowing and nobody’s actually consuming the power), now you can use that to mine Bitcoin.

India's Rise of Crypto

#64💎 Now that China’s taken itself out of crypto, it has kind of left the door open for others.

#65💎 And over the last nine months, Indian crypto has just absolutely exploded. They’ve all just gone vertical with the rise of cryptocurrency this year.

#66💎 There’re multiple India crypto unicorns, and Indians are a huge part of the global crypto community. And in the meantime, China has basically forced mining outside.

#67💎 I’m cautiously bullish in both the US and India on cryptocurrency and I’m cautiously optimistic that both India and China will maintain some degree of stability.

#68💎 India could be an intermediate between kind of a coming American anarchy and total Chinese control.

More Gems

#69💎 There are some sort of techno idealists or techno optimists who sort of paint this decentralized future that is just utopian in almost every respect. – Tim Ferris

#70💎 Conversely, the transhumanist thing is the opposite, which says, “What makes us human is technology.”

#71💎 Cooking Made Us Human essentially says that technology is actually part of humanity in the sense that we sort of outsource our metabolism to cooking and therefore could evolve in a different way.

#72💎 You take the countries that we have today that the people no longer feel a loyalty to, you’re unbundling them into the coming American anarchy, and then you’re going to rebundle them on the other side into groups that do have something in common, and that will be probably a really messy global process when this Pax Americana falls.

#73💎 The internet plus Satoshi Nakamoto led to the decentralization — by analogy the Reformation — led to the counter-decentralization, led to potentially the coin wars, the American anarchy, and then question mark, question mark, and then network states.

#74💎 Centralization, de-centralization, re-centralization is like entity unbundling, rebundling. It’s like CDs, individual MP3s playlists. It is newspapers, individual articles, Twitter feeds. It is countries, anarchy, new countries, new cities.

#75💎 The wheel was reinvented. In fact, there’s this great graphic that shows like an original stone wheel and then like a chariot wheel and then like a modern Michelin tire.

#76💎 We are a technological species, technology is not some anti-human thing, it is humanity, there is a difference between us versus animals, and so, our destiny is to get to the stars.

#77💎 Twitter, Square, and Facebook are still founder-led. Because they’re founder-led, they’re getting into, respectively, Bitcoin and Web3.

#78💎 Cryptographic truth: I don’t care if something has a thousand retweets, what I care about is if it has two or three independent confirmations from economically dis-aligned actors.

#79💎 We have to think about what the next system looks like after that. How do we ensure that we don’t have crypto-anarchy, but crypto-civilization?.